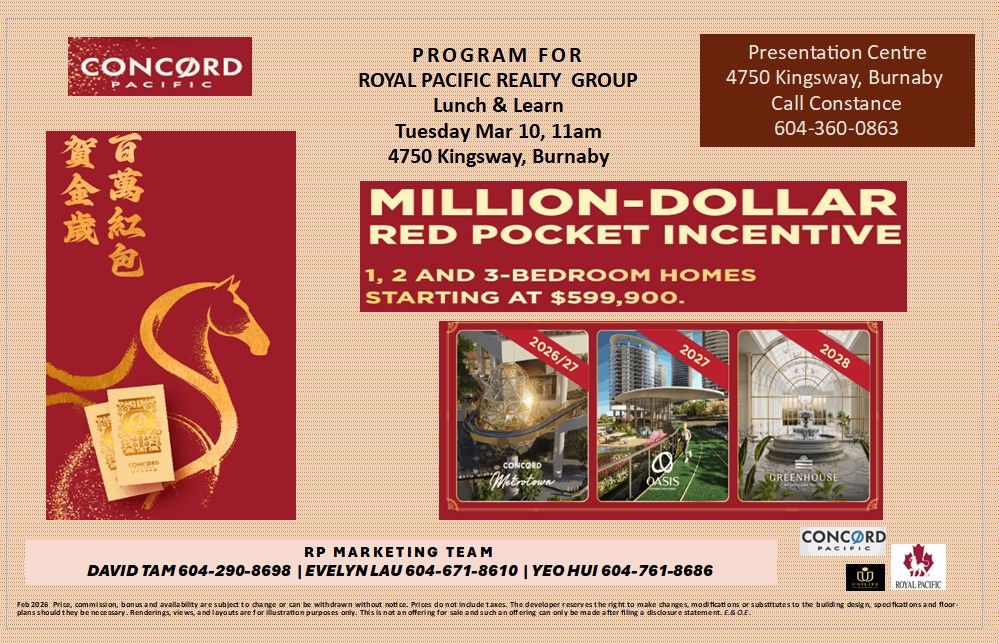

Date: Tuesday March 10, 2026

Time: 11:00 am

Location: Concord Presentation Centre, 4750 Kingsway, Burnaby

Food and drink to celebrate Year of Horse.

REGISTER: https://forms.gle/rqn2ZQ4K8tcP56Rk9

Date: Tuesday March 10, 2026

Time: 11:00 am

Location: Concord Presentation Centre, 4750 Kingsway, Burnaby

Food and drink to celebrate Year of Horse.

REGISTER: https://forms.gle/rqn2ZQ4K8tcP56Rk9

Special Incentives:

New year gifts will be provided to all attendees

Exciting bonus opportunities for agents

Buyers' incentives starting at $88,888

Prize draws including gift cards and an Oura Ring

Event Details:

Date/Time: Thursday, February 26th, 2026, from 2–4 PM

Location: Point Grey Golf Club, 3350 SW Marine Dr, Vancouver (free visitor parking available)

Limited seats, registration is a must : https://forms.gle/XVmXng9MCawFJs8T8

Date: Wednesday Feb. 18, 2026

Time: 2:00 pm - 4:00 pm

Location: 1067 W. Cordova St., Vancouver

Food and drink to celebrate Year of Horse.

REGISTER: https://forms.gle/xEp64UBEu7kkV11s7

Date: Thursday, February 12, 2026

Time: 1:00 pm - 3:00 pm

Location: 8415 Granville Street, Vancouver

Enjoy curated food & champagne

Receive exclusive Lunar New Year incentives with special pricing revealed on site

Enter to exclusive prize draw

REGISTER: https://forms.gle/8NLSXzYZ7Yyim2wTA

DATE: Tuesday February 10, 2026

TIME: 11:00 am – 1:00pm

LOCATION: 2762 Granville Street

SIGN UP: https://forms.gle/dU7qkGowxoWPjKk19

MORE INCENTIVES WILL BE ANNOUNCED ON THIS DAY.

You’re warmly invited to the Lunar New Year event at Park Residences II

Feb 7 (Sat) | 1–4 PM

7351 Elmbridge Way, Richmond, BC V6X 1B8

Red envelopes / Lion dance / Special incentives

RSVP here:

https://spark.re/dwkl/park-residences-ii/rsvp-event/lunar-new-year-2026

Date: Wednesday February 18, 2026

Time: 12:00 noon

Location: 100 - 1200 West 73rd Avenue, Vancouver

(Royal Pacific head office at Airport Square)

Registration link: https://forms.gle/dnRksTHXeZEq9b3Y9

Dear Royal Pacific Agents,

You are warmly invited to join us for our Lunar New Year Lunch, generously sponsored by John Carlisle Law Corporation and CIBC Sky Tong Team.

Come enjoy a festive afternoon with Great Food, Red Wine, Good Company, and Holiday Cheer!

We will also have the Money God delivering gold coins and good fortune to all participants!

Please mark your calendar—we look forward to celebrating with you.

Wishing you all a Prosperous and Joyful Year of the Horse!

Thank you, and see you there!

RSVP: Please confirm your attendance by Monday, February 16, 2026

VANCOUVER, BC – February 3, 2026 – Last year’s market trends continued in January as home sales registered on the MLS® in Metro Vancouver* were 28.5 per cent lower than last year, setting the year off to a quieter start.

The Greater Vancouver REALTORS® (GVR) reports that residential sales in the region totalled 1,107 in January 2026, a 28.7 per cent decrease from the 1,552 sales recorded in January 2025. This was 30.9 per cent below the 10-year seasonal average (1,602).

There were 5,157 detached, attached and apartment properties newly listed for sale on the Multiple Listing Service® (MLS®) in Metro Vancouver in January 2026. This represents a 7.3 per cent decrease compared to the 5,566 properties listed in January 2025. This was 19.4 per cent above the 10-year seasonal average (4,318).

The total number of properties currently listed for sale on the MLS® system in Metro Vancouver is 12,628, a 9.9 per cent increase compared to January 2025 (11,494). This is 38 per cent above the 10-year seasonal average (9,153).

Across all detached, attached and apartment property types, the sales-to-active listings ratio for January 2026 is 9.1 per cent. By property type, the ratio is 6.7 per cent for detached homes, 11.1 per cent for attached, and 10.3 per cent for apartments.

SURREY, BC – Home prices in the Fraser Valley fell for the tenth consecutive month in January, pushing the Benchmark price below $900,000 for the first time since spring 2021.

The Benchmark price for a typical home in the Fraser Valley dropped one per cent in January to $897,200, down 6.9 per cent year-over-year. The continued softening of prices wasn’t enough to get buyers off the sidelines, as the Fraser Valley Real Estate Board recorded 619 sales on its Multiple Listing Service® (MLS®) in January, a 33 per cent decrease from December, and 24 per cent below sales from the same month last year. New listings increased 128 per cent in January to 3,078, reflecting the typical seasonal patterns; however, activity remained 10 per cent below last year’s levels.

Overall inventory remains above seasonal norms for the Fraser Valley, with 7,711 active listings, up 11 per cent from December and 54 per cent above the 10-year seasonal average.

The Fraser Valley remains firmly in a buyer’s market, with an overall sales-to-active listings ratio of eight per cent in January, down five per cent from December. A balanced market is typically defined by a ratio between 12 and 20 per cent.

Across the Fraser Valley in January, the average number of days to sell a single-family detached home was 55 days, while for a condo it was 53 days. Townhomes took, on average, 50 days to sell.

REALTORS® play a central role in guiding their clients through the twists and turns of real estate transactions, but they are rarely a solo act. Rather they are a part of a larger cast of professionals who work together to ensure their clients’ success in those transactions.

When acting for buyers, REALTORS® are expected to help clients find the property to be purchased, advise them on the appropriate price for the property, help negotiate the price and terms of the purchase transaction, present their offers to the sellers, and at times handle deposit funds paid by their clients.1

When acting for sellers, REALTORS® are expected to help clients advertise and show their property. They could also find buyers, advise on the appropriate sale price, present any offers received, and negotiate the price and terms of the sale transaction.2

Some transactions may appear to be run-of-the-mill, while others may raise unusual questions, whether as a result of client particularities, questions from other parties to the transaction, unusual contractual clauses, or unusual features of a property.

Regardless of the kind of transaction, REALTORS® are expected to spot issues that may require the input of other professionals. They are also required to recommend that their clients engage those professionals, and to work cooperatively with them in a team-based approach to client service. These duties are all contained within the general duty of a REALTOR® to “act with reasonable care and skill.”3

Spotting issues that may fall outside a REALTOR®’s area of expertise demonstrates professionalism and provides value to their clients.

In a recent BC case, the real estate agent’s failure to recommend legal advice to his seller client was found to constitute a breach of the standard of care expected of him.4 The property in the case was an unusual type of strata property, which would have required a complex process to amend the strata plan in order to permit the development of a new home up to the maximum floor area permitted by the city’s zoning bylaws. The Court found there were sufficient red flags for the agent to doubt the information provided by the seller about the property, and that the agent should have recognized the limits of their own expertise and proactively recommended that their clients obtain legal advice (early on in the agency relationship).5

There are many types of professionals a REALTOR® may need to suggest their client consults in the course of a real estate transaction. Some of these are home inspectors, contractors, appraisers, lawyers, accountants, tax advisors, environmental consultants, archaeological consultants, or even other REALTORS® who may be more familiar with a particular geographical area or type of property.

For example, a REALTOR® asked to list a property for a married couple, where one spouse has moved into long-term care, may refer the clients to a lawyer before even taking the listing. This is to ensure that the clients are both competent enough to give instructions, and / or that appropriate documents are prepared to enable the other spouse to sell the property.

A REALTOR® assisting a buyer in purchasing a development property that has an easement, right-of-way, or covenant registered on title may refer the buyer to a lawyer to ensure that the buyer understands the impact of those title charges on their plans for the property.

The REALTOR® may also consider whether the buyer would benefit from obtaining a property survey, if one is not already available from the seller, and from retaining an architect or development consultant familiar with any local planning regulations that might apply. It’s best if this is done early on in the transaction.

When dealing with a property that may have structural or safety concerns, whether disclosed by the seller in a Material Latent Defect form, Property Disclosure Statement, or discovered by a home inspector during the home inspection, a REALTOR® may consider referring their buyer to a contractor, engineer, or other professional to ensure the scope of the concerns is understood before proceeding with the purchase. The same applies to more unusual property types, such as leasehold properties, time-shares, or commercial properties, as well as unusual purchase structures like share purchases, joint ventures, or partnerships, which may lead to potential issues. In these cases, clients will benefit from timely advice from professionals such as lawyers, accountants, or tax advisors.

REALTORS® should recommend legal advice immediately in transactions that appear to be collapsing, or where there is uncertainty about whether the Contract of Purchase and Sale is still “alive.” In another recent BC case, a real estate agent was found negligent for not recommending that her buyer clients seek legal advice immediately when they instructed her to collapse the contract unilaterally. The Court commented that a reasonable REALTOR®, upon receipt of such instructions, should have provided basic advice about the impact of that decision on the buyers’ legal rights (such as the forfeiture of the deposit, and perhaps additional damages), and should have told them to immediately seek independent legal advice.6

It is important that REALTORS® encourage their clients to consult the appropriate professionals and that clients have sufficient time and opportunity to find the right professionals for their particular issues during the transaction, or even proactively, before entering into the transaction.

When referring other professionals, REALTORS® should endeavour to provide their clients with options of multiple qualified professionals with whom they have had successful past working experiences.7 REALTORS® can also provide their clients with a neutral referral service, such as a directory of professionals practicing in the area. Examples include the Lawyer Referral Service,8 or professional association directories for particular professions, such as the British Columbia Association of Professional Archaeologists,9 and more. REALTORS® may wish to make it clear that they are not personally endorsing the other professionals, and that clients should do their own due diligence.10

To minimize their own risk of liability, REALTORS® should document their referrals in writing and should refrain from directly retaining any professionals on behalf of their clients.11 It is best for the client to directly engage the professional, provide them instructions, communicate directly for advice, and negotiate payment for their services. This avoids the risk of miscommunications and any dispute over the scope of the services or over who should pay for the professional’s services.

A REALTOR®’s role in providing real estate services in a transaction is to act as a trusted advisor for their client, coordinating many aspects of the transaction. Working collegially with a client’s other professional advisors will reduce risk, enhance client trust, and produce better outcomes for the client.

The new Property Disclosure Statement (PDS) and Property No-Disclosure Statement (PNDS) represent a fundamental change to the day-to-day practice of residential real estate disclosure in British Columbia. The new disclosure forms, released by BCREA in response to the BC Court of Appeal decision in Sewell v. Abadian,1 recognize the change in the approach of the court. This article reviews the recent changes and the new forms. It also discusses ways to educate buyers and sellers of residential real estate on the use of disclosure forms.

In many real estate boards and associations across the province, the PDS is a mandatory inclusion in a brokerage’s file; however, before now, the seller was not legally required to complete a PDS. This led to a practice within the sector of submitting a crossed-out PDS or a PDS with some form of general disclaimer statement (e.g., “as-is” or “tenanted property, seller did not occupy”) where a seller wished to provide no disclosure.

This approach was supported by the court in Smith v. Reder and Carleton,2 where the seller had written “AS-IS” on the PDS. The Court applied the ordinary rule of caveat emptor or buyer beware, finding that the buyer was responsible for doing her own due diligence in that situation, and there was no further duty on the seller to disclose.

This approach began to change in other Canadian jurisdictions, finding that “…where there is no PDS prepared, a prudent purchaser would be expected to contract for a more thorough home inspection if the buyer wished to avoid future costly surprises. Where a PDS has been prepared, however, the buyer should be able to rely on the truthfulness and accuracy of the representations in the PDS in deciding the extent to which a contractor will be instructed to conduct a home inspection.”3

Where sellers completed the PDS (or similar disclosure documents) in other Canadian jurisdictions, those sellers were required to provide disclosure that was honest and complete. This requirement has always applied in British Columbia as well; however, recent case law, including Smith4 and Sewell,5 has emphasized a broader duty of forthrightness in disclosure.6

In Sewell v. Abadian,7 the BC Supreme Court, following historical precedent, initially found in favour of the seller who had struck a line through the PDS and wrote in the comments, “Tenanted Property, Owner has never occupied.” The Court denied the recovery of a deposit to the buyer who claimed the seller had misrepresented an unpermitted addition.

The buyer appealed, and despite the seller’s apparent intent not to make any representations, the BC Court of Appeal interpreted the strike-out form differently.8 The court held that it constituted a representation that the seller had no knowledge regarding the items in the form, and that if the seller did, in fact, possess any such knowledge, this would amount to a misrepresentation by the seller.

The key points of the BC Court of Appeal regarding the completion of the PDS in this case are as follows:

the seller knew the importance of filling out a disclosure statement accurately;

the seller knew that a disclosure statement he had received from a prior owner of the property disclosed the unpermitted addition;

the seller had a choice of not providing a disclosure statement and saying nothing, but instead chose to provide one and to agree that it would be incorporated into the contract;

the disclosure form specifically stated that the seller was responsible for the accuracy of the answers, and where uncertain, should reply "do not know";

the disclosure statement also stated that the information provided was true, based on the seller's current actual knowledge, and that any important changes to this information made known to the seller would be disclosed prior to closing; and

the additional comments, "tenanted property" and "owner has never occupied," were not responsive to the questions on the form asking for information about the property.

The Court of Appeal made it clear that the sector practice of crossing out a PDS with a disclaimer statement was problematic, and this practice did not eliminate the risk of confusion and misrepresentation.

Another interesting observation of the Court of Appeal’s findings in Sewell v. Abadian9 is that the contract’s instruction page appeared to influence how a court interpreted the rights and responsibilities of a party to that contract, in the absence of contractual terms to the contrary.

In response to the change in law, BCREA has released a revised PDS and PNDS to assist sellers in making timely and accurate disclosure.

REALTORS® should encourage forthright and honest disclosure by sellers, as this is the best way to mitigate risks for all parties. Additionally, they should provide the PDS to their sellers to complete and then review the completed form with them. REALTORS® are strongly cautioned to refrain from completing the PDS for clients or making selections for electronic signature on a PDS form in advance of written client instructions.

When providing the PDS to sellers for completion, the following key points should be communicated clearly to the client:

the completion of a PDS is optional, but disclosure does assist the transaction process;

in the event you choose to complete the PDS, please fill it out completely, honestly, and be fully transparent based on your current knowledge;

the PDS will likely be incorporated into the contract and relied upon by the buyer even if the buyer does their own inspection;

a misrepresentation (including a partial, incomplete or non-response) may result in liability;

where there are changes to the property that affect the information in the disclosure, please let your REALTOR® know, as they may need to update the PDS; and

if the client is worried about the legal risks of disclosure or no-disclosure, they should seek legal advice prior to entering into any Contract of Purchase and Sale (CPS).

REALTORS® acting for sellers should review the completed PDS form with their client after they have viewed the property, obtained the city file from the relevant municipality (which may include permits, building plans and any recorded bylaw infractions held by the local government authority), and reviewed an initial title search. The REALTOR® should ask whether the representations made by the seller match their understanding of the property based on the REALTOR®’s own initial due diligence.

Where a potential misrepresentation has been identified (e.g., the seller says “no” to 3Q Unauthorized Accommodation, but the REALTOR® is aware there is an unpermitted suite from the city file), then the REALTOR® needs to make further inquiries, seek the advice of their managing broker, and ultimately bring the issue to the attention of their client. If the client’s non-disclosure relates to a material latent defect, REALTORS® must advise the seller that they are obligated under Section 59 of the Real Estate Services Rules10 to disclose the defect to the buyer or the buyer’s agent. If the seller refuses to permit this disclosure, the REALTOR® must decline to provide trading services and cease acting for the client.

The PNDS is a very simple disclosure consisting of only two concise statements:

“In lieu of a detailed Property Disclosure Statement, the Seller is not making any representations or warranties about the Property. The Seller is aware of their obligation to disclose any known latent defects.”

The approach is clearly a response to the court expanding the parties’ obligations to the form instructions and is meant to clearly elect to make “no disclosure.”

There will be situations where sellers may choose not to complete a PDS, including estate sales, tenant properties under third-party management, or foreclosures.

When providing the PNDS to sellers for completion, the following key points should be communicated clearly to the client:

Completion of a PNDS may make some buyers suspicious of potential issues. While this may delay or hinder a transaction, it will also alert the buyer to undertake their own due diligence process.

Completion of a PNDS does not excuse you from disclosing any latent defects with respect to the property, meaning any defect that is not discoverable by reasonable inspection and renders the property dangerous or uninhabitable. In addition, your REALTOR® is required to further disclose all material latent defects. This is a broader definition and includes defects which render the property dangerous, uninhabitable, unfit for its purpose, or where there is a bylaw or other notice of non-compliance or a lack of permits. For more information, see the BC Financial Services Authority information page on Material Latent Defects.11

Failure to lawfully disclose carries legal risk. If the client is worried about the legal risks of disclosure or non-disclosure, they should seek legal advice prior to entering into any CPS.

A final takeaway that cannot be overlooked from the court’s decision in Sewell v. Abadian12 is the weight placed on the instructions attached to the PDS. It can be expected that courts will continue to look to the form instructions when interpreting not only the PDS but also the other forms used by REALTORS®. A prudent REALTOR® will ensure that these instructions from the CPS, PDS, and other forms are reviewed with clients as part of their client education process, and such conversations are recorded in their file as part of their record-keeping process.

VANCOUVER, B.C. – October 2, 2025 – Another Bank of Canada rate cut and easing prices helped home sales registered on the MLS® in Metro Vancouver* edge higher relative to September last year.

The Greater Vancouver REALTORS® (GVR) reports that residential sales in the region totalled 1,875 in September 2025, a 1.2 per cent increase from the 1,852 sales recorded in September 2024. This was 20.1 per cent below the 10-year seasonal average (2,348).

There were 6,527 detached, attached and apartment properties newly listed for sale on the Multiple Listing Service® (MLS®) in Metro Vancouver in September 2025. This represents a 6.2 per cent increase compared to the 6,144 properties listed in September 2024. This was 20.1 per cent above the 10-year seasonal average (5,434).

The total number of properties currently listed for sale on the MLS® system in Metro Vancouver is 17,079, a 14.4 per cent increase compared to September 2024 (14,932). This is 36.1 per cent above the 10-year seasonal average (12,553).

Across all detached, attached and apartment property types, the sales-to-active listings ratio for September 2025 is 11.3 per cent. By property type, the ratio is 8.5 per cent for detached homes, 12.7 per cent for attached, and 13.3 per cent for apartments.

When it comes to real estate, you’re always making the right decision by choosing a Unilife Realty REALTOR®. Over 100 professional, motivated, and trustworthy REALTORS® are committed to delivering you results from research, to negotiations, to the finalization of transactions. Learn More

Search our directory or contact us today to let us find a REALTOR® to help you today. Contact Us

Join the fast growing team at Unilife Realty – Western Canada’s largest independent real estate organization. Join Today

© 2023 Unilife Realty. All rights reserved. Realtor® Area

![]() The data relating to real estate on this website comes in part from the MLS® Reciprocity program of either the Real Estate Board of Greater Vancouver (REBGV), the Fraser Valley Real Estate Board (FVREB) or the Chilliwack and District Real Estate Board (CADREB). Real estate listings held by participating real estate firms are marked with the MLS® logo and detailed information about the listing includes the name of the listing agent. This representation is based in whole or part on data generated by either the REBGV, the FVREB or the CADREB which assumes no responsibility for its accuracy. The materials contained on this page may not be reproduced without the express written consent of either the REBGV, the FVREB or the CADREB.

The data relating to real estate on this website comes in part from the MLS® Reciprocity program of either the Real Estate Board of Greater Vancouver (REBGV), the Fraser Valley Real Estate Board (FVREB) or the Chilliwack and District Real Estate Board (CADREB). Real estate listings held by participating real estate firms are marked with the MLS® logo and detailed information about the listing includes the name of the listing agent. This representation is based in whole or part on data generated by either the REBGV, the FVREB or the CADREB which assumes no responsibility for its accuracy. The materials contained on this page may not be reproduced without the express written consent of either the REBGV, the FVREB or the CADREB.

©Copyright 2023 Unilife Realty. All rights reserved. | Privacy Policy | Powered by myRealPage