VANCOUVER, BC – March 3, 2026 – Metro Vancouver* home sales registered on the MLS® in February continued the recent trend of slower-than-average sales, seeing a ten per cent decline over the same period last year.

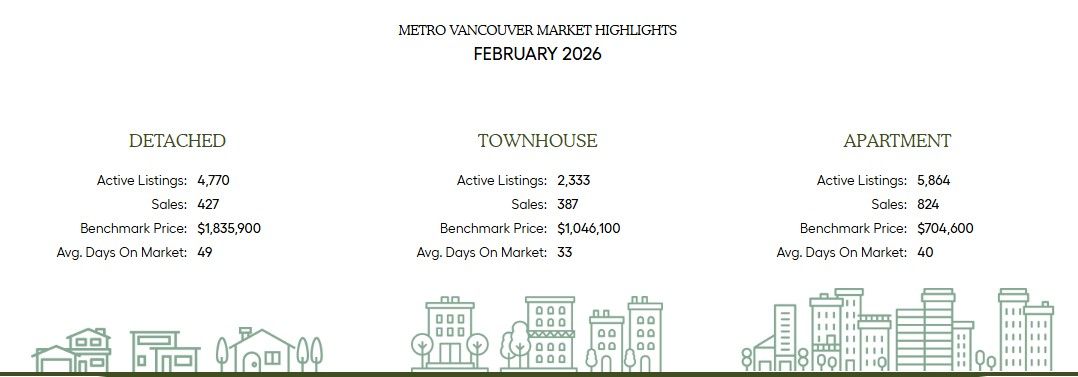

The Greater Vancouver REALTORS® (GVR) reports that residential sales in the region totalled 1,648 in February 2026, a 9.8 per cent decrease from the 1,827 sales recorded in February 2025. This was 28.7 per cent below the 10-year seasonal average (2,310).

There were 4,734 detached, attached and apartment properties newly listed for sale on the Multiple Listing Service® (MLS®) in Metro Vancouver in February 2026. This represents a 6.4 per cent decrease compared to the 5,057 properties listed in February 2025. This was 7.1 per cent above the 10-year seasonal average (4,421).

The total number of properties currently listed for sale on the MLS® system in Metro Vancouver is 13,545, a 6.3 per cent increase compared to February 2025 (12,744). This is 37 per cent above the 10-year seasonal average (9,886).

Across all detached, attached and apartment property types, the sales-to-active listings ratio for February 2026 is 12.6 per cent. By property type, the ratio is nine per cent for detached homes, 16.6 per cent for attached, and 14.1 per cent for apartments.