Property owners receive their 2025 assessment notices the first week of January, an assessment which reflects the market value as of July 1, 2024.

"Across the Lower Mainland and throughout BC, the overall housing market has generally stabilized in value for a second consecutive year," said BC Assessment (BCA) Assessor Bryan Murao. "Most homeowners can expect only modest assessment changes in the range of -5% to +5%."

For detached homes in the Greater Vancouver area, Burnaby and Pemberton tied with a four per cent increase. Other increases ranged from zero to three per cent.

For strata homes, the highest increase was two per cent in Port Coquitlam, Port Moody, and Delta. Following with an increase of one per cent was Coquitlam, the District of North Vancouver, Squamish, and Richmond.

For detached homes, the biggest drop was in Surrey which saw a three per cent decrease, followed by Pitt Meadows, with a two per cent decrease. Langley and Surrey stratas declined two per cent, while Vancouver and West Vancouver stratas declined one per cent.

For new construction or substantially renovated homes, the estimate is based on the physical condition as of October 31, 2024.

Viewing the assessment notice

Property owners can also see a property’s assessment using the address on BCA’s website.

Details include a photo, a property description (land and buildings), the total assessed value, the previous year’s value, the legal description and property ID.

If property details are incorrect, property owners are directed to complete and submit an Data Validation Form.

Property owners can also compare neighbouring properties and sample sold properties to decide whether their property has been correctly assessed.

Deadline to appeal assessment is January 31, 2025

Property owners who disagree with their assessment should do homework by:

comparing their assessment with neighbouring properties; and

contacting BCA at 1-866-825-8322, talking with staff who can make adjustments if there’s an obvious error, for example if BCA included a complete renovation when there was only a spruce-up or an upgrade for plumbing or electrical.

Property owners who decide to appeal their property assessment should review information on the Property Assessment Appeal Board website on how to prepare for an appeal.

Each year less than one per cent of BC property owners appeal their assessments.

Note: you can’t appeal your taxes. You can only appeal your assessment.

For information about BC Assessment and to access e-valueBC visit: www.bcassessment.ca or phone 1‑866-825-8322.

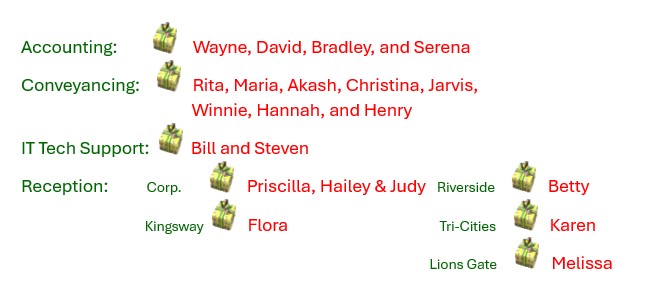

Sample property value changes year-over-year, by neighbourhood

Source: BC Assessment

Did you know?

BCA is a provincial Crown corporation, since 1974 responsible for determining and reporting property value estimates.

Number of properties assessed province-wide: 2,207,009, an almost increase of one per cent from 2023.

Total value of the 2025 roll is $2.83 trillion, an increase of just over per cent from 2023.

Total value of new construction, subdivisions and rezoning: $38.3 billion, a decrease of over three per cent from the 2024 Roll of $39.6 billion.

For the Lower Mainland region, total assessments generally remained flat from about $2 trillion in 2024, to $2.01 trillion this year.

Almost $27.2 billion of the region's updated assessments is from new construction, subdivisions and the rezoning of properties.

Property tax

Property taxation is set by local and provincial taxing authorities after determining their budget needs and calculating property tax rates based on the assessment roll for their jurisdiction.

Municipalities determine tax rates for each property class in the spring, once the assessment roll is finalized. Changes in assessment over the year don’t automatically translate into the same percentage changes in property taxes for any particular class of property or for any individual property.

Questions?

Contact BC Assessment